The economic and financial crisis is one aspect. The scale of the decline in production in the months following March 2020 will be unprecedented compared to the crises of the last 70 years. There is no doubt about it. Hundreds of millions people have suddenly lost their jobs and their livelihoods. The drop in economic activity is huge and will last for a long time. Now is the time to think and act to bring about radical changes. This is a race against time. On one hand, we have those who claim that they will change everything so that nothing changes and the world resumes its normal capitalist way of functioning as soon as possible. On the other, we have those who genuinely want deep change.

The coronavirus pandemic must be seized as an opportunity to move towards a genuine revolution to radically change society in its way of life, its mode of ownership, its mode of production and its relationship with Nature. We must plan de-growth while improving living conditions. We must give absolute priority to common goods, and relocate manufacturing and services while adapting production to make it compatible with our struggle against the environmental crisis. The sphere of public services under citizen control must be massively enlarged. This revolution will only take place if the victims of the capitalist system and of patriarchal society are self-active, self-organizing and shunt the 1% and their lackeys away from the various centres of power to create real democratic power. A self-managing, anti-racist and feminist ecological-socialist revolution is needed.

In what follows I will examine measures taken by central banks as well as likely financial conflagrations.

Measures taken by central banks

Since mid-March 2020, major central banks have made massive attempts to prevent the current financial fire from spreading and to avoid other conflagrations. It is important to emphasize that their priority is to help major private banks or other financial institutions as well as, more generally, major shareholders of big corporations, whether they be in the manufacturing industry or not. Central banks help the 1% to the detriment of the 99% while claiming to serve the general interest. Central banks are trying to protect a wobbly globalized capitalist system.

As they swamp the financial markets with cash, they hope to circumvent the fire, as they did from 2008-2009 onward, which resulted in the current debacle.

It is essential to be aware of the various conflagrations that could occur within the coming days, weeks and months. It will help understand where the major central banks and governments are heading to, whatever their discourse.

But let us first remember the role played by central banks.

Reminder of measures taken by central banks since 2008

The policy followed by central banks is not the main cause of the current crisis of the capitalist system but it clearly contributes to it. Through their interference, notably to help big private corporations after 2008, they did prevent the capitalist system from going through a repetition of the big recession of the 1930s in its most brutal forms. I am referring to what happened from 1929 to 1945: a succession of bankruptcies, the suspension of debt payments by some thirty countries (including Germany, Britain, France, Belgium, Italy and 14 Latin American countries) [1], the victory of Nazism, [2] the Second World War, all of which were brutal shocks. But such interference resulted in the ingredients that have produced another financial crisis and did not actually boost production [3]. Another financial crisis broke out on a global scale in February-March 2020. This global crisis came after a number of more smaller financial crises that the Fed had attempted to smother in the United States throughout 2019.

While the mainstream media and governments constantly reiterate that the economic and financial crisis has been caused by the coronavirus pandemic, I have insisted that all the elements for a new financial crisis had been ready for several years and that coronavirus was merely the spark or the detonator of the stock-market crisis and not its cause. The amount of inflammable material in the financial sphere reached saturation point several years ago and it was well known that a spark could and would set off an explosion. No-one knew when the explosion would happen or what would spark it off, but it was clear that it was bound to happen. I also pointed out that the crisis in production had begun before coronavirus appeared on the scene, affecting the world’s main economies from the first semester of 2019 [4].

The present financial crisis is global. All stock markets have been affected whether in Europe, the Americas, Asia-Pacific or Africa. Losses from 17 February to 17 March 2020 amount to between 20 and 40% depending on the stock market; only those in China limited their losses (the Shanghai stock market fell by 7%). On 1 April 2020, the main stock markets on all continents collapsed again.

As this is being written, on 18 April 2020, the stock markets have regained between fifteen and twenty points between 17 March and 17 April 2020 thanks to the massive injections of cash and the huge bailout packages announced by the major central banks and governments. But the markets’ situation has not stabilized, and more crashes can’t be ruled out. It should also be stressed that the market value of shares of major corporations has fallen drastically: Boeing’s stock dropped 53% between 1 January 2020 and 18 April 2020; that of the biggest oil company, Exxon Mobil, dropped 38% and the second-ranking oil company, Chevron, 27%; the largest US bank, JPMorgan, lost 32%; the largest petrochemical group, Dow, 39%; Goldman Sachs lost 20% and Caterpillar 22%. On the Frankfurt exchange, since 1 January 2020, VW’s stocks have lost 30% of their value, BMW’s 30%, and Mercedes-Daimler’s 41%; Siemens stocks are down 30%, and Deutsche Bank’s 14%. On the Paris exchange, Airbus has lost 56%; among the banks Crédit Agricole has lost 49%, Société Générale 55% and BNP Paribas 52%; Peugeot is down 45% and Renault 61%.

Measures announced after the 2007-2008 financial crisis

Measures announced in 2008 and 2009 to discipline the banks eventually proved to be no more than announcements. Central monitoring of banks in the Eurozone, the creation of a European fund to guarantee deposits, the prohibition of certain operations (concerning only 2% of total banking activity), the capping of bonuses, the transparency of banking activities or the new banking regulation rules, Basel III and IV… all these were merely recommendations, promises. At best, all measures that were actually taken were completely inadequate to deal with the problems at hand.

Yet this was already too much for the big banks and as a consequence, in January 2020, Trump’s administration did away with a large part of the Volcker Rule, adopted during Barack Obama’s administration. In January-February 2020, the Central Bank of China also allowed Chinese banks to take more risks so as to try and boost the economy. At the end of March 2020, the Fed, the ECB and the Basel Committee lifted almost all restrictions that had been imposed on banks after the 2007-2008 crisis. The enforcement of the Basel III agreement has been postponed for several years. [5].

Sharp increase in private debt and new speculative bubbles created in the last ten years

The policies of the major central banks have led, on one hand, to a very sharp rise in companies’ private debt, and on the other, to a speculative bubble on financial asset quotations. There has been grossly exaggerated stock-market capitalization, overvaluation and inordinate volume of the corporate bonds (= securities issued by companies in order to borrow) market, and property sector bubbles in the United States and China. All this, and especially the disastrous rescue of the private finance system since 2007-2008 using public money, has also given rise to an increase in public debt.

The speculative bubbles mentioned above are mostly caused by the policies adopted by the major central banks (the US Federal Reserve or Fed, the ECB, the Bank of England, over the last ten years, and the Bank of Japan since the burst of the property bubble in the 1990s). They injected thousands of billions of dollars, euros, pounds sterling and yen into private banks to keep them afloat. These policies were known as Quantitive Easing. The funds that the central banks distributed profusely were not used by banks and big capitalist companies from other sectors for productive investment. They were used to acquire financial assets: stocks and shares, sovereign public debt bonds, structured products and derivatives. This has produced a speculative bubble on the stock market, on the bond market (that is debt bonds), and in some places, in the property market. All the big companies are over-indebted.

The central banks’ policies bear witness to the fact that their directors’ decisions are entirely based on the short term interests of major private banks and large capitalist firms in other sectors. They seek to prevent a chain of bankruptcies which would cause enormous losses to major share-holders.

Financial bubbles have been encouraged by central banks and are an integral part of how the financialized capitalist system functions

This policy is consistent with a characteristic of contemporary financialized capitalism: an ever-smaller share of the new value created is reinvested in production [6].

A growing portion of new value is distributed to share-holders, in the form of dividends, in the form of share buybacks, in the form of speculative investments, especially structured products and derivatives. François Chesnais makes particular mention of an ever more massive inflow of the non reinvested profits of mainly industrial finance groups. [7] Michel Husson has also put his finger on this characteristic of contemporary capitalism several times.

The Fed’s action in March 2020

Faced with a stock-market bubble which began bursting in the second half of February 2020, the Fed decided on 3 March 2020 to fix its benchmark federal funds rate in a target range of 1 % to 1.25 %, a fall of 0.50 %, the biggest over recent years as until now the Fed lowered its rates in 0.25 % stages. Faced with the continued slump of stock markets and especially of banks on the edge of bankruptcy, the Fed decided a further reduction on 15 March 2020, hitting even harder than on 3 March. This time it brought the rate down by 1 %. So since 15 March the Fed’s new federal funds rate is in a range of 0 to 0.25 %. Banks are being encouraged to increase their debts.

Not content with reducing interest rates, the Fed has again started injecting enormous amounts of dollars onto the inter-banking market. For once again, the banks have lost confidence in one another and are unwilling to lend one another money. The Chair of the Fed declared that his institution had planned, over the following weeks, to inject more than 1000 billion dollars of liquidities on the short-term markets, especially the repo market (5), in which it has already intervened massively between September and December 2019. The abbreviation “repo” (for repurchase agreement) designates the mechanism whereby banks finance themselves for a short period. They sell securities, with a commitment to repurchase them rapidly. For example they deposit US Treasury bonds or securities of companies with a triple A rating for 24 hours, as warranty or collateral for the loan they are making. In exchange for these bonds, they obtain cash at an interest rate close or equal to the federal funds rate.

Then, from 23 March, the Fed went further. It began to buy massive amounts of structured products linked to the property market, whether for residential property (Mortgage Backed Securities, MBS) or commercial property (Commercial Mortgage Backed Securities, CMBS). In the last week of March alone, it repurchased more than 250 billions’ worth of MBS and CMB from the banks.

The Fed is also purchasing other dangerous structured financial products: CLOs (Collateralized Loan Obligations) and CDOs (Collateralized Debt Obligations), which are rated as low as BBB- (the rating just above junk bonds). It is also buying shares in certain companies to try to limit their collapse.

What’s more, it is making massive purchases of debt, including extremely high-risk debt, of private companies (corporate bonds).

On the Repo market, on 17 March, the Fed suddenly ramped up its activities by injecting 90 billion dollars in a single day [8]. Since that date, it has injected between 10 and 20 billion per day into the Repo market as soon as there is a shortage of cash.

In addition, it made an agreement with all the big central banks on other continents to supply them with hundreds of billions of dollars in order to avoid even greater international financial chaos. In summary, the Fed’s intervention is significantly greater than in September 2008 on the day after the failure of Lehman Brothers and the collapse of the USA’s biggest insurance company (AIG) and General Motors.

The ECB’s actions in March 2020

Under the direction of Christine Lagarde, the European Central Bank (ECB), whose prime rate is 0%, announced on 12 March 2020 that it would be increasing its purchases of private and public financial securities (bonds and structured financial products, on the one hand, and government bonds on the other). It will also increase the volume of advantageous credits granted to banks in the middle and long term.

Banks who promise not to reduce the volume of loans they grant to the private sector can get ample financing from the ECB at a negative rate (-0.75%). Note that there are no penalties if they fail to keep those promises. That means that they actually make money when they borrow from the ECB – a virtual subsidy. Banks repay less to the ECB than the amount they borrow. If they borrow €100, they repay only €99.25.

And as we mentioned above, the Fed, the ECB and other central banks, beginning in March 2020, have reduced the few measures of “control” that had been taken following the preceding financial crisis of 2007–2008 and are promising almost unlimited laxity on the pretext that banks are the key intermediaries of economic recovery.

Central banks and the other regulators allow big banks to take even more risks

The Fed, the ECB and other central banks have announced that banks no longer need to adhere to rules regarding the minimum amount of cash they must have on hand in order to face a financial upheaval. Similarly, the central banks have reduced their requirements regarding the ratio between the bank’s equity and its commitments (its balance sheet). This means that the banks can now take even more risks than before. In terms of the freedom banks are allowed, we have more or less gone back to the situation that existed prior to the crisis in 2007–2008.

The big banks have been clamouring for exactly that for years. They had already succeeded in reducing the requirements placed on them by the central banks and the regulatory authorities. Now they are being given licence to go back to doing more or less whatever they please.

The British financial daily, the Financial Times, calculated that measures announced by the different central banks over a period of three weeks have reduced the reserves and equity that the banks are supposed to hold permanently by 500 billion dollars. [9]. The FT writes: “By allowing banks to operate with lower levels of capital, regulators are boosting their firepower to absorb higher demand for loans as well as rising customer defaults and a deterioration in credit quality in their loan books.” [10]

The central banks are asking the big banks to temporarily suspend payments of big dividends to their shareholders and stop buybacks of their own shares

To attempt to limit the popular discontent that will well up once the people become aware of the gifts they’re giving to the private banks, the central banks, and in particular the Fed and the ECB, are asking banks to stop buying back their own shares on the stock market and to limit dividend payments. On 27 March, the ECB announced that it was asking the two hundred biggest banks in the Eurozone to stop, for a limited period, buybacks of their own shares.

You’ll recall that banks in the USA have, over the last ten years, bought back their own shares for a total of 860 billion dollars, and in 2019 alone buybacks reached a total of 47.5 billion dollars. Added to that is the nearly 80 billion dollars banks paid in the form of dividends to their shareholders in 2019. And the European banks have done exactly the same as their US counterparts.

As mentioned above, the major US banks have announced that they are bringing repurchase of their own shares to a halt until September 2020. However they are pushing hard to continue to be able to distribute dividends to their share-holders even as they receive massive aid from the public purse!

Note that the US banks have just boasted to their share-holders that they made enormous profits thanks to massive sales of shares on the stock markets during the first quarter of 2020. Banks get commission on all share sales, right across the spectrum. The more shares change hands on the markets, the more money the banks earn, even if market values fall. According to the Financial Times of 26 March 2020 the revenues of US banks relating to stock-market activities increased by 30 % in February-March 2020. This increase concerns the 12 biggest banks. This will not prevent them from declaring losses on their global activities, to avoid paying tax.

The next conflagrations

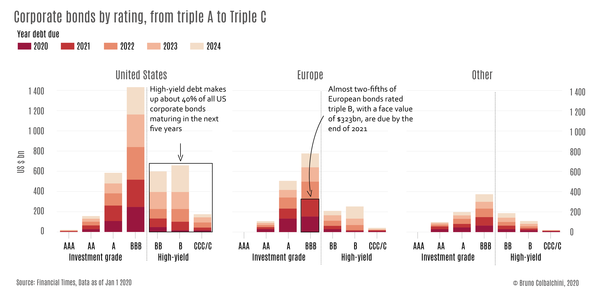

Before the start of the crisis, the market for high-risk, high-yield debt securities reached a volume of about 2,200 billion dollars (this refers to bonds that have credit ratings from BB to C –see the graphics). The market for better-quality debt bonds (“investment grade”, that go from AAA to BBB) was much bigger and reached about 4,500 billion dollars. The trouble is that since March 2020, the credit rating agencies downgrade on a daily basis dozens of bonds (for hundreds of millions or billions of dollars). In the USA, this concerns debt securities issued by big corporations such as Ford and General Motors. At the beginning of April, debt bonds issued by Ford for a total of 36 billion dollars were downgraded by the credit rating agencies. They went from BBB (investment grade) to BB (i.e. junk bonds). So now they are considered as high-risk. Altogether by March 2020, 90 billion dollars of debt securities considered to be quite good quality had been downgraded to the high-risk category (junk) [11].

Now as can be clearly seen on the graphics below, a very great deal of “investment grade” debts fall into the BBB category, which is precisely the category that is being downgraded on a massive scale to be transformed into the BB category or “junk bonds”. The graphs show how things were in January 2020 before the coronavirus crisis broke out. Since March, the situation has worsened considerably.

Like Ford, very large corporations – industrial, commercial, financial and others – are beginning to encounter enormous difficulties in repaying the colossal debts they’ve accumulated over the past ten years.

Banks lend for the long term (generally in the form of purchases of debt securities issued by all types of companies) and to finance the loans they make, they generally borrow in the short term. What is happening now is a repeat of 2007-2008, with banks having lent massively long-term (over a period of five to six years) without looking too closely at the quality and credit rating of borrowers (generally big companies but also families, students, etc.) as long as the yield was good. Borrowers are directly affected by the crisis and are having more and more difficulty repaying their debts. Banks have been using short-term financing from other banks and financial corporations, in particular on the repo market, and they also borrow from the Fed. Since banks once again no longer trust each other and other financial corporations are extremely wary of banks, the Fed and other central banks (such as the ECB) intervene by injecting huge quantities of cash to keep banks and other companies from failing, all in order to protect their major shareholders.

That will not prevent a sharp drop in the market value of debt securities, which will combine with the collapse of stock markets. In other words, a new bubble is in the process of bursting. After the stock-market bubble that begun to burst dramatically in February–March 2020, the bond-market bubble has also begun to burst. And yet another bubble was preparing to burst – the mortgage market in the USA. The crisis affects both the residential mortgage market and the commercial mortgage market (office and business space, etc.)

But since so many major industrial corporations are heavily indebted, it’s highly possible that some of them will go under. That should also hold true for other sectors: recall the highly publicized failure of the British travel agency Thomas Cook on 23 September 2019 – well before the Coronavirus epidemic. Thomas Cook was unable to repay a debt that was in excess of two billion euros. Other major travel firms will fail for reasons related to the crisis. Airlines will fail. Oil companies will fail – unless States intervene yet again to bail out their major shareholders with public monies.

As mentioned above, the central banks and the governments of the most industrialised countries managed to limit the damage in 2007–2008 and avoid a repetition of the crisis of the 1930s by injecting thousands of billions of dollars into the works. Of course the Lehman Brothers bank did fail in September 2008, but in the USA the other major corporations who were on the edge of failure, including the largest insurance company worldwide, AIG, and General Motors, were bailed out at public expense.

The same thing happened in Europe with the Royal Bank of Scotland in the UK, Natixis in France and some twenty other big banks in Ireland, Germany, Belgium, Switzerland, Italy, Spain, Holland, Greece, Slovenia and Cyprus; certain banks were nationalised to bail out their major shareholders. Thanks to that type of massive intervention, the major shareholders came out of the crisis in very good shape, which led to even further financial concentration. Average-sized and large banks have been bought out by the largest ones. This movement has taken place in the USA, Belgium, Spain, Portugal, Greece and elsewhere, but this type of intervention by central banks and States has not brought about the purge the capitalist system needed, in “its” own interest, in order to be able to return to the path of expansion.

We should point out that the high growth rates of the major industrial economies date back to the 30 years that followed the start of the Second World War in the case of the USA and the period following the War in the case of Europe and Japan. Then, from the 1970s–1980s, the rate of growth decreased [12] and financialisation of the economy greatly increased. That led to a first major financial crisis in 1987, and then to the one in 2000–2001, then the 2007–2008 crisis, which was followed by a worldwide drop in production in 2009 and afterward by ten years of slow growth [13] everywhere but in the financial sphere, where speculative bubbles developed for the nth time in the history of world capitalism.

To sum up, between 2010 and 2020, growth of production and productivity has been weak in the former major industrial powers in North America and Europe. China has acted as the world’s locomotive.

One thing is clear: compared to the intervention of the central banks starting in 2008 [14], which was massive, their intervention beginning in March–April 2020 is even more colossal. To make a concrete comparison, the intervention of the central banks is a little like what their respective governments did during the catastrophes at Chernobyl in 1986 and Fukushima in 2011. They attempted to contain the meltdowns by burying certain parts of the nuclear plants in concrete, or else by flooding them. That approach can limit the damage, but it can never solve the problems.

Conclusion

It is of fundamental importance that a strategy be put into practice that makes a radical and complete break with the capitalist system and its deadly logic. Just as we need to shut down all nuclear generating plants, the capitalist system must be got rid of and modes of production, concepts of ownership, the relationship between human beings and between humans and Nature – our very way of living – must be completely called into question.